There are many reasons to get rid of a business partner. In fact, my guilty pleasure is prying into the lives of business partner problems on Reddit. The same mistakes are made over and over again by these wantrepreneurs. I have the luxury of pointing and laughing, but for these posters, the stress is real.

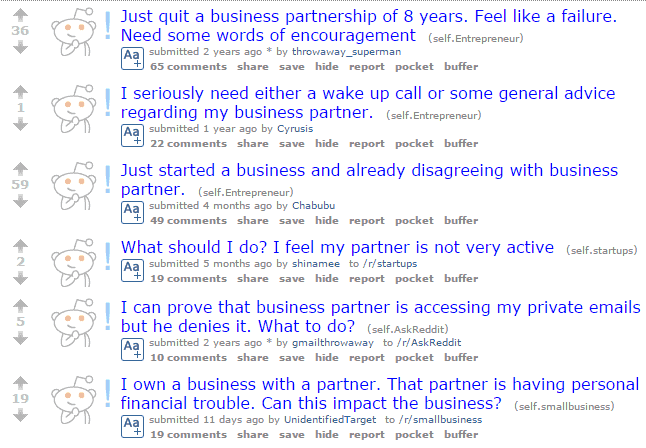

For those seasoned, you do not want to miss these stories in r/entrepreneur and r/startups:

Should You Get Rid of a Co-Founder Who Murders People?

Though most “bad partner” stories involve one partner not putting in their fair share or going rogue, but every once in a while, your co-founder just needs to be dropped because of a murder charge. That is what happened to the co-founder of Plaxo, Minh Nguyen, who has been charged with first-degree murder.

Plaxo is not alone. If it is not a murder charge, it could easily be something else. The co-founder of Tinder just settled a sexual harassment lawsuit. The feds charged the co-founder of BitInstant for money laundering. The CEO and founder of RadiumOne Inc. ended up pleading guilty to a battery charge and lost his job for it.

Depending upon the charges and your tolerance level, maybe you can put up with an alleged criminal as a partner. For those less flexible, it may be time for you to get rid of your partner–or maybe you have some less dramatic, yet legitimate, reason.

You May Have Already Lost If You Did Not Prepare

Easy for an attorney to say in hindsight that you should have done this or that, but the reality is that if you want to get rid of a business partner, you will be limited by the initial agreements you signed in the inception of the partnership (corporation, LLC, etc.) itself. If this was not planned ahead, you will have much more trouble than the company that believed in being prepared.

Assuming you are not at the point of no return and you are still forming your relationship with the co-founder, here are only a few simple tools to look into before diving into a deal.

Keep Control of Your Business

First, do what any control freak would do and hold on to your business as tight as possible without giving up any control to anyone else but yourself. Read more on how to keep control of your business. Even where you give up equity, find a way to grab it back through option agreements.

Performance Based Equity Interest

Second, use performance based equity interest. Just because you start as 50-50 partners (which is almost always a bad idea), it does not mean that it must stay that way regardless of whether either partner is pulling his or her weight.

There a few ways to structure performance based equity interest but common ways include using the concept that co-founders need to earn their equity by contributing their service through a vesting schedule.

If it is not sweat equity, maybe it is about money contribution over time. For example, mandatory contributions calls in an LLC is a common way to ensure everyone pulls their weight financially.

Plan Your Divorce Through a Prenup

Lastly, unlike a marriage, it is not as taboo to plan your business divorce before entering into the relationship with your co-founders. Yes, it does force you to have difficult conversations, but this is where a good legal counsel can help guide all the founders.

Sometimes it is not even about a bad actor or a partner that is not doing his or her fair share. It could just be that it is no longer a good fit or unavoidable consequences require a different ownership structure.

There are some really useful tools out there that can help deal with various situations. For example, you could set up a buy-sell arrangement that allows any partner to offer to buy the ownership interest of the others at a specific price per share. The other owners then must either accept the offer and sell their ownership interest, or buy the triggering owner’s interest at that same price. This is the classic “shotgun” clause that has many other variations.

Somewhat related to vesting schedules, buy back options may be appropriate where equity is contingent upon long-term performance or the continued cooperations and performance of a particular partner. Such buybacks may be priced with a premium to avoid misuse, but still allow a smooth breakup in the event the relationship is just not working out.

Squeeze Out That Minority Partner Until They Bleed Out

If you have all the control and are a majority owner of your LLC/corporation, do not think you can just flick your little finger to push a co-owner out of your business. Even minorities in interest have some basic rights. Those rights may be limited or expanded by your formation and operating documents, but there are some rights that may not ever be taken away. For example, even where the law allows a forced merge out, freeze out, or squeeze out, the minority owners would still be entitled to their fair market value of the ownership.

As a majority owner, you still have significant fiduciary duties to the business and acting in your personal best interest against minority owners may not fly. That means any actions that may be characterized as an abuse of discretion, unreasonable or arbitrary, in bad faith, or even fraudulent will be heavily scrutinized.

Majority owners can easily fall in the trap of abuse of its minority owners via unreasonably high salaries, unreasonable withholding of dividends, transactions that are not arm’s length, sale of all the assets of the company, or issuance of securities (to dilute the minority owner).

Though minorities have rights, assuming the operating documents do not provide otherwise, you very likely have the ability to run the business freely without having to work hand and hand with your minority owner. Providing them with the required reporting and access to records may be the only minimal burden upon you in operating the business.

If there is an employment agreement between the minority owner and the company, be careful in terminating your part-owner as it should be treated like any employment relationship.

At the end, the only economical way (by avoiding litigation) to kick out a partner is negotiating a buyout.

Pay Your Partner to Go Away In Lieu of Coming Back Another Day

If you are having issues with a partner, you have to find a balance between running your business as normal and dealing with the problem head on. In most cases, it just comes down to negotiating a number. How much will it take to get rid of that partner?

If there are any buy-sell agreements or other referenced buyout procedures contemplated in your formation or operating documents, this should just be a matter of execution. If not, then you will have to bring the parties together at the negotiation table.

Valuation is always a contentious issue. Unlike a capital raise, suddenly the founders are fighting to minimize the value of their company in order to buy back ownership from a departing partner. Though there is an entire science in valuing a business, the only real value is what the outgoing partner is willing to take for walking away from a company that he or she has been a part (however small or large) since its inception. The answer is that most likely they will take more than what you want and you will pay less than what they want–the imperfect compromise.

Quick note: negotiating a buyout is not always just about how much money for equity interest. In early business divorces, the intend ownership of intellectual property often does not match reality. Does your company really own that code or that invention? If not, make sure it is included in your negotiation before the buyout.

Know When to Walk Away

Sometimes the business has not done well enough to really fight for it. Perhaps it is a tech startup where the only real asset is some development code that could easily be replicated or redone if need be. At the end, it could just not be worth the cost to litigate a business divorce than it compared to the cost of just dissolving, liquidating, and going your separate ways.

“Walk away” does not mean to literally walk away and hope the company’s problems resolve itself. If the entity and its dissolution is structured properly, you should not be personally liable for the debts, but you still could be exposed to liability for certain types of claims or if assets are inappropriately taken out of the business with it still owing money to creditors. You will have to go through the dissolution or similar process before you can literally walk away.

Know When to Fight

Litigation is hell, but some things are worth fighting. This area of the law can get nasty and the term business divorce is not a hyperbole.

Many of the solutions in getting rid of the partner does require the consent of all the parties. For example, even if you have a buy-sell agreement, one of the parties still may put up a fight or protest under some legal theory.

Such disputes are more likely to occur when the business is doing well and worth something. Unfortunately, if you have gotten to this point, you have already lost. Your valuable business will be drowned in legal fees plus the often forgotten secondary costs of the stress it will have on operations that occurs when company founders are litigating.

![More Than a Mistake: Business Blunders to Avoid [312] Top Five Business Blunders](https://www.pashalaw.com/wp-content/uploads/2021/06/Pasha_LSSB_Blunders_WP-1-1024x723.jpg)

![Law in the Digital Age: Exploring the Legal Intricacies of Artificial Intelligence [e323]](https://www.pashalaw.com/wp-content/uploads/2023/11/WhatsApp-Image-2023-11-21-at-13.24.49_4a326c9e-300x212.jpg)

![Unraveling the Workforce: Navigating the Aftermath of Mass Layoffs [e322]](https://www.pashalaw.com/wp-content/uploads/2023/07/Untitled-design-23-300x212.png)

![Return to the Office vs. Remote: What Can Employers Legally Enforce? [e321]](https://www.pashalaw.com/wp-content/uploads/2023/01/Pasha_LSSB_321_banner-300x212.jpg)

![Explaining the Hans Niemann Chess Lawsuit v. Magnus Carlsen [e320]](https://www.pashalaw.com/wp-content/uploads/2022/10/LAWYER-EXPLAINS-7-300x169.png)

![California v. Texas: Which is Better for Business? [313]](https://www.pashalaw.com/wp-content/uploads/2021/07/Pasha_LSSB_CaliforniaVSTexas-300x212.jpg)

![Buyers vs. Sellers: Negotiating Mergers & Acquisitions [e319]](https://www.pashalaw.com/wp-content/uploads/2022/06/Pasha_LSSB_BuyersVsSellers_banner-300x212.jpg)

![Employers vs. Employees: When Are Employment Restrictions Fair? [e318]](https://www.pashalaw.com/wp-content/uploads/2022/05/Pasha_LSSB_EmployeesVsEmployers_banner-1-300x212.jpg)

![Vaccine Mandates Supreme Court Rulings [E317]](https://www.pashalaw.com/wp-content/uploads/2022/02/WhatsApp-Image-2022-02-11-at-4.10.32-PM-300x212.jpeg)

![Business of Healthcare [e316]](https://www.pashalaw.com/wp-content/uploads/2021/11/Pasha_LSSB_BusinessofHealthcare_banner-300x212.jpg)

![Social Media and the Law [e315]](https://www.pashalaw.com/wp-content/uploads/2021/10/WhatsApp-Image-2021-10-06-at-1.43.08-PM-300x212.jpeg)

![Defining NDA Boundaries: When does it go too far? [e314]](https://www.pashalaw.com/wp-content/uploads/2021/09/Pasha_LSSB_NDA_WordPress-2-300x212.jpg)

![More Than a Mistake: Business Blunders to Avoid [312] Top Five Business Blunders](https://www.pashalaw.com/wp-content/uploads/2021/06/Pasha_LSSB_Blunders_WP-1-300x212.jpg)

![Is There a Right Way to Fire an Employee? We Ask the Experts [311]](https://www.pashalaw.com/wp-content/uploads/2021/02/Pasha_LSSB_FireAnEmployee_Website-300x200.jpg)

![The New Frontier: Navigating Business Law During a Pandemic [310]](https://www.pashalaw.com/wp-content/uploads/2020/12/Pasha_LSSB_Epidsode308_Covid_Web-1-300x200.jpg)

![Wrap Up | Behind the Buy [8/8] [309]](https://www.pashalaw.com/wp-content/uploads/2020/11/Pasha_BehindTheBuy_Episode8-300x200.jpg)

![Is it all over? | Behind the Buy [7/8] [308]](https://www.pashalaw.com/wp-content/uploads/2020/09/iStock-1153248856-overlay-scaled-300x200.jpg)

![Fight for Your [Trademark] Rights | Behind the Buy [6/8] [307]](https://www.pashalaw.com/wp-content/uploads/2020/07/Fight-for-your-trademark-right-300x200.jpg)

![They Let It Slip | Behind the Buy [5/8] [306]](https://www.pashalaw.com/wp-content/uploads/2020/06/Behind-the-buy-they-let-it-slip-300x200.jpg)

![Mo’ Investigation Mo’ Problems | Behind the Buy [4/8] [305]](https://www.pashalaw.com/wp-content/uploads/2020/05/interrobang-1-scaled-300x200.jpg)

![Broker or Joker | Behind the Buy [3/8] [304] Behind the buy - Broker or Joker](https://www.pashalaw.com/wp-content/uploads/2020/04/Joker-or-Broker-1-300x185.jpg)

![Intentions Are Nothing Without a Signature | Behind the Buy [2/8] [303]](https://www.pashalaw.com/wp-content/uploads/2020/04/intentions-are-nothing-without-a-signature-300x185.jpg)

![From First Steps to Final Signatures | Behind the Buy [1/8] [302]](https://www.pashalaw.com/wp-content/uploads/2020/04/first-steps-to-final-signatures-300x185.jpg)

![The Dark-side of GrubHub’s (and others’) Relationship with Restaurants [e301]](https://www.pashalaw.com/wp-content/uploads/2015/04/When-Competition-Goes-Too-Far-Ice-Cream-Truck-Edition-300x201.jpg)

![Ultimate Legal Breakdown of Internet Law & the Subscription Business Model [e300]](https://www.pashalaw.com/wp-content/uploads/2019/05/Ultimate-Legal-Breakdown-of-Internet-Law-the-Subscription-Business-Model-300x196.jpg)

![Why the Business Buying Process is Like a Wedding?: A Legal Guide [e299]](https://www.pashalaw.com/wp-content/uploads/2019/03/futura-300x169.jpg)

![Will Crowdfunding and General Solicitation Change How Companies Raise Capital? [e298]](https://www.pashalaw.com/wp-content/uploads/2018/11/Will-Crowdfunding-and-General-Solicitation-Change-How-Companies-Raise-Capital-300x159.jpg)

![Pirates, Pilots, and Passwords: Flight Sim Labs Navigates Legal Issues (w/ Marc Hoag as Guest) [e297]](https://www.pashalaw.com/wp-content/uploads/2018/07/flight-sim-labs-300x159.jpg)

![Facebook, Zuckerberg, and the Data Privacy Dilemma [e296] User data, data breach photo by Pete Souza)](https://www.pashalaw.com/wp-content/uploads/2018/04/data-300x159.jpg)

![What To Do When Your Business Is Raided By ICE [e295] I.C.E Raids business](https://www.pashalaw.com/wp-content/uploads/2018/02/ice-cover-300x159.jpg)

![General Contractors & Subcontractors in California – What you need to know [e294]](https://www.pashalaw.com/wp-content/uploads/2018/01/iStock-666960952-300x200.jpg)

![Mattress Giants v. Sleepoplis: The War On Getting You To Bed [e293]](https://www.pashalaw.com/wp-content/uploads/2017/12/sleepopolis-300x159.jpg)

![The Harassment Watershed [e292]](https://www.pashalaw.com/wp-content/uploads/2017/12/me-2-300x219.jpg)

![Investing and Immigrating to the United States: The EB-5 Green Card [e291]](https://www.pashalaw.com/wp-content/uploads/2012/12/eb-5-investment-visa-program-300x159.jpg)

![Responding to a Government Requests (Inquiries, Warrants, etc.) [e290] How to respond to government requests, inquiries, warrants and investigation](https://www.pashalaw.com/wp-content/uploads/2017/10/iStock_57303576_LARGE-300x200.jpg)

![Ultimate Legal Breakdown: Employee Dress Codes [e289]](https://www.pashalaw.com/wp-content/uploads/2017/08/Ultimate-Legal-Breakdown-Template-1-300x159.jpg)

![Ultimate Legal Breakdown: Negative Online Reviews [e288]](https://www.pashalaw.com/wp-content/uploads/2017/06/Ultimate-Legal-Breakdown-Online-Reviews-1-300x159.jpg)

![Ultimate Legal Breakdown: Social Media Marketing [e287]](https://www.pashalaw.com/wp-content/uploads/2017/06/ultimate-legal-breakdown-social-media-marketing-blur-300x159.jpg)

![Ultimate Legal Breakdown: Subscription Box Businesses [e286]](https://www.pashalaw.com/wp-content/uploads/2017/03/ultimate-legal-breakdown-subscription-box-services-pasha-law-2-300x159.jpg)

![Can Companies Protect Against Foreseeable Misuse of Apps [e285]](https://www.pashalaw.com/wp-content/uploads/2017/01/iStock-505291242-300x176.jpg)

![When Using Celebrity Deaths for Brand Promotion Crosses the Line [e284]](https://www.pashalaw.com/wp-content/uploads/2017/01/celbrity-300x159.png)

![Are Employers Liable When Employees Are Accused of Racism? [e283] Racist Employee](https://www.pashalaw.com/wp-content/uploads/2016/12/Are-employers-liable-when-an-employees-are-accused-of-racism-300x159.jpg)

![How Businesses Should Handle Unpaid Bills from Clients [e282] What to do when a client won't pay.](https://www.pashalaw.com/wp-content/uploads/2016/12/How-Businesses-Should-Handle-Unpaid-Bills-to-Clients-300x159.png)

![Can Employers Implement English Only Policies Without Discriminating? [e281]](https://www.pashalaw.com/wp-content/uploads/2016/11/Can-Employers-Impliment-English-Only-Policies-Without-Discriminating-300x159.jpg)

![Why You May No Longer See Actors’ Ages on Their IMDB Page [e280]](https://www.pashalaw.com/wp-content/uploads/2016/10/IMDB-AGE2-300x159.jpg)

![Airbnb’s Discrimination Problem and How Businesses Can Relate [e279]](https://www.pashalaw.com/wp-content/uploads/2016/09/airbnb-300x159.jpg)

![What To Do When Your Amazon Account Gets Suspended [e278]](https://www.pashalaw.com/wp-content/uploads/2016/09/What-To-Do-When-Your-Amazon-Account-Gets-Suspended-1-300x200.jpg)

![How Independent Artists Reacted to Fashion Mogul Zara’s Alleged Infringement [e277]](https://www.pashalaw.com/wp-content/uploads/2016/08/How-Independent-Artists-Reacted-to-Fashion-Mogul-Zaras-Alleged-Infringement--300x159.jpg)

![Can Brave’s Ad Replacing Software Defeat Newspapers and Copyright Law? [e276]](https://www.pashalaw.com/wp-content/uploads/2016/08/Can-Braves-Ad-Replacing-Software-Defeat-Newspapers-and-Copyright-Law-300x159.jpg)

![Why The Roger Ailes Sexual Harassment Lawsuit Is Far From Normal [e275]](https://www.pashalaw.com/wp-content/uploads/2016/07/WHY-THE-ROGER-AILES-SEXUAL-HARASSMENT-LAWSUIT-IS-FAR-FROM-NORMAL-300x159.jpeg)

![How Starbucks Turned Coveted Employer to Employee Complaints [e274]](https://www.pashalaw.com/wp-content/uploads/2016/07/iStock_54169990_LARGE-300x210.jpg)